For other goods and services (eg children’s clothes and most foods) the VAT rate is 0% (this is known as the ‘zero rate’). However, for some goods and services (eg children’s car seats and home energy), the VAT rate is 5% (this is known as the ‘reduced rate’).

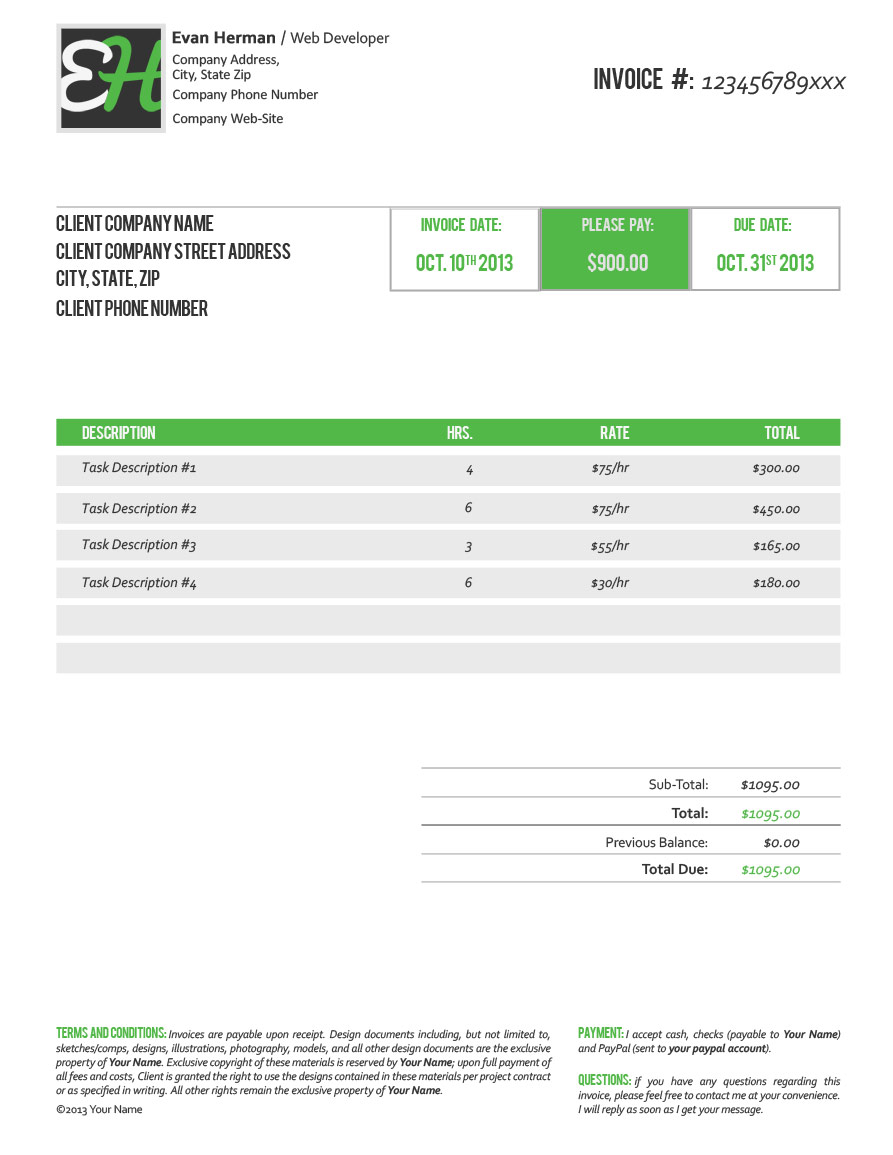

The standard rate of VAT payable on most goods and services is 20%. Make sure you charge the correct rate of VAT However, if you do this, you may want a lawyer to review or change the Invoice for you, to make sure it complies with all relevant laws and meets your specific needs. If you want your Invoice to include further or more detailed provisions, you can edit your document. This section sets out what payment method(s) the seller accepts and provides details of how the buyer can make payments under the Invoice. The sub-total and the amount of VAT payable (if applicable) The discount percentage and the discount amount (if applicable) It also provides:Ī description and specification of the items and/or services being sold The body of the Invoice sets out the details that all Invoices should include, such as their number, date and payment period.

The Invoice is addressed to the accounts payable department at the buyer.

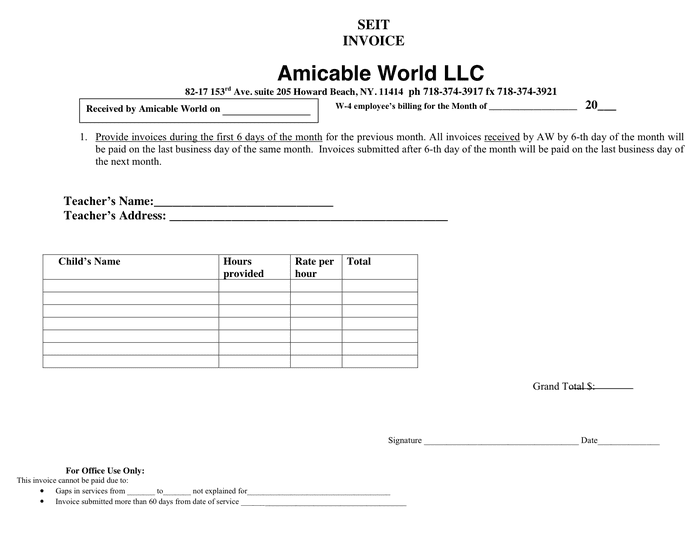

This will only be displayed if the Invoice will not be printed on headed paper that includes the seller’s name and address. The Invoice starts by setting out the seller’s name and address. Was a purchase order created for this Invoice? If so:ĭoes the seller accept payments made using:Ĭredit cards? If so, what is the seller’s phone number for credit card payments?ĭebit cards? If so, what is the seller’s phone number for debit card payments?īank transfers? If so, what are the seller’s bank account details?īy making an Invoice you provide a record of goods sold and/or services provided, and the amount payable in exchange for them. Is VAT applicable to the goods or services being sold? If so: What are the details of the items or services being sold (including a description, quantity and price)?ĭoes a discount apply to the total price? If so, what is the discount percentage? How many days does the buyer have to pay the Invoice? The buyer’s details (eg legal structure, name and address). Will the Invoice include the seller’s website address? If so, what is it? Will the Invoice include the seller’s email address? If so, what is it? If not, what is the seller’s name and their address? Will the Invoice be printed on headed paper including the business’ name and address? To make your Invoice you will need the following information: When you have all of the details prepared in advance, making your document is a quick and easy process. Just answer a few questions and Rocket Lawyer will build your document for you. See the Government website for information on VAT Invoices. VAT Invoices should be used where both businesses involved in the transaction are VAT registered. VAT-registered businesses must also include: Payment methods and details (eg a bank account number and sort code)Ī Purchase order number (if required by your client) The name of the client that is being invoicedĪ brief description of the services provided or goods supplied and individual costs/fees

#Sample invoices full#

The business’ name (for companies, this should be the full company name as it appears on the certificate of incorporation)Ĭontact information, including an email address and phone number

The word ‘invoice’ (this should be clearly displayed at the top of the document)Ī number that uniquely identifies this Invoice

#Sample invoices how to#

Use this Invoice template to learn how to write an Invoice.Īs a minimum, Invoices (like this sample Invoice) should include:

0 kommentar(er)

0 kommentar(er)